Zhiyanzhan released: "Analysis Report on Development Prospects and Investment Strategic Planning of China's Wire and Cable Industry"

Wire and cable industry concept

As key wire products, wires and cables are mainly used to transmit electrical energy, transmit information, and achieve effective conversion of electromagnetic energy. They are indispensable basic components in power, communications and various electrical equipment. They undertake important energy transmission and information transmission functions and provide solid support for the development of modern society.

Wire and cable industry upstream, midstream and downstream

The wire and cable industry chain can be roughly divided into three parts: upstream, midstream and downstream. The upstream industry mainly provides raw materials for Steel Wire Drawing Machine. This includes metal raw material industries such as copper and aluminum, which provide the conductor parts of wires and cables; at the same time, the rubber industry and chemical industries such as polyethylene and polyvinyl chloride are also important parts of the upstream, which provide the manufacturing of cross-linked insulation sleeves and sheathing materials. Materials required. The quality and supply stability of these raw materials directly affect the quality and cost of wire and cable products. The midstream is a wire and cable manufacturing company. They use the raw materials provided by the upstream to manufacture various wire and cable products through a series of processes and equipment. These products include power cables, communication cables, electrical equipment cables, bare wires, winding wires, etc., which are widely used in various fields such as power, communications, construction, and transportation. The technical level and production capacity of midstream enterprises determine the variety, specifications and quality of wire and cable products. Downstream are industries that have demand for wires and cables, mainly including power, communications, transportation, construction and other industries. With the country's continued investment in infrastructure construction and the power communications industry, as well as the rapid development of emerging industries, such as new energy vehicles, data centers, etc., the demand for wires and cables continues to grow. The development status and market demand of downstream industries directly affect the sales and market prospects of the wire and cable industry.

Wire and cable industry classification

The wire and cable industry is a diversified and finely classified field, and its classification can be divided from different dimensions. According to the national economic industry classification standards, the wire and cable industry belongs to the electrical machinery and equipment manufacturing industry, which is a major category in the manufacturing industry. It is specifically subdivided into the manufacturing of wires, cables, optical cables and electrical equipment, and is further subdivided. to wire and cable manufacturing. According to their uses and functions, wires and cables can be divided into several major categories, including power cables, wires and cables for electrical equipment, communication cables and optical cables, bare wires, and winding wires. Each of these categories serves different industries and applications, for example, power cables are primarily used for power transmission, while communication cables are used for data transmission. In terms of specific product types, the wire and cable industry is further subdivided into subcategories such as bare wires, power cables, electrical equipment cables, communication cables and electromagnetic wires. Bare wire is the most basic form, does not contain any insulation or protection, and is typically used for high-voltage transmission lines. Power cables and electrical equipment cables have different specifications and characteristics according to application requirements to meet the requirements of different environments and equipment. Communication cables are mainly used for information transmission, while electromagnetic wires are widely used in the windings of motors and various instruments. From the perspective of the industrial chain, the upstream of the wire and cable industry is mainly raw material suppliers, including the provision of basic metals such as copper, aluminum and their alloys, as well as chemical products used to manufacture insulation layers and sheaths. In the midstream are wire and cable manufacturing companies, which are responsible for processing raw materials into finished products. Downstream industries include various industries that require the use of wires and cables, such as construction, power, communications, and construction machinery.

Chart: Wire and Cable Industry Classification

Development history of wire and cable industry

The development history of China's wire and cable industry has a long history, which can be traced back to the early days of industrialization. In the early 20th century, with the increasing demand for electricity, the wire and cable industry began to emerge. However, it was not until the Kunming Wire and Cable Factory was officially put into operation in 1939 that my country's wire and cable industry truly entered a new stage of development. After the founding of New China, the industry ushered in new development opportunities, especially the establishment of Shenyang Cable Factory in 1954, which injected new impetus into the large-scale development of wire and cable production. With the deepening of reform and opening up, the surge in market demand and technological progress have promoted the rapid expansion of the industry's scale and the increasing variety of products. Entering the 21st century, the wire and cable industry continues to maintain a strong momentum of development, benefiting from the acceleration of national infrastructure construction and the rapid development of emerging fields. However, in recent years, with the intensification of market competition and the slowdown of industry growth, the wire and cable industry has gradually entered a mature development period. Under the guidance of policies, the industry began to focus on quality brand building and shifted towards high-quality development. A group of companies with innovative capabilities and market competitiveness emerged, leading the industry to move in a more high-end, smart, and green direction.

Chart: Development history of the wire and cable industry

Supply and demand situation of wire and cable industry

China's wire and cable industry is experiencing significant differentiation between supply and demand. The mid-to-low-end product market is experiencing overcapacity and fierce competition, causing companies to face huge price pressure and shrinking profit margins. Overcapacity exceeds 50% and equipment utilization is low. At the same time, in the field of high-end products, the domestic market is in short supply, especially in key areas such as aerospace, nuclear power and high-voltage cables, which rely heavily on imports, with foreign companies accounting for more than 80% of the market share. In addition, the industry concentration is low and there are many small and medium-sized enterprises, which intensifies the intensity of market competition. Although China is the world's largest cable producer, its investment in technology research and development is insufficient, resulting in domestic companies' lack of competitiveness in the high-end market. However, as China's economy transitions to high-quality development, the demand for special cables is growing day by day. Sales revenue of special cables is expected to reach approximately 700 billion yuan in 2023, demonstrating the market's urgent demand for high-quality products. Therefore, the wire and cable industry needs to accelerate structural adjustment and technological innovation to adapt to market changes and meet the growing demand for high-quality products.

Operation status of wire and cable industry

my country's wire and cable industry as a whole shows a growth trend, but the market concentration is relatively low, indicating that market competition is fragmented and there is a lack of monopoly companies. Market data in 2020 shows that the concentration ratio of the top five companies is 12%, the top ten is 18%, and the top twenty is only 23%. In terms of corporate revenue scale, differentiation has occurred within the industry, forming different competitive groups. Among them, 12 of the more than 20 listed companies mainly rely on wire and cable revenue, accounting for more than 80% of their operating revenue, and are divided according to revenue scale. for four echelons. Although the revenue of these companies continues to grow, profits are facing downward pressure, possibly due to rising raw material costs, fierce market competition and falling product prices. In terms of output, China's power cable and optical cable output continues to grow, reflecting the continued demand for domestic infrastructure construction and related industry development. As an important indicator that reflects market supply and demand and raw material price changes, price index has a significant impact on product prices. The sales revenue of enterprises above designated size in China's wire and cable industry is the key data to measure the operating efficiency of the industry. It shows the market size and economic benefits of the entire industry. In general, although my country's wire and cable industry maintains growth, it faces challenges from fierce market competition and profit margins. At the same time, the growth in output and changes in the price index also reveal some of the operating status of the industry.

Wire and cable industry market size

China's wire and cable industry achieved a market size of 1.17 trillion yuan in 2022, and is expected to further grow to 1.20 trillion yuan in 2023, marking the industry's continued growth momentum. In this huge market, there are an extremely large number of companies, with small and medium-sized enterprises as the main body. As of the end of 2022, the total number has reached 30,300, of which more than 2,000 were newly registered in 2021. Despite the impact of the epidemic on the global economy, China's wire and cable production achieved a year-on-year growth of 4.5% in 2021, reaching 54.8 million kilometers. In terms of market structure, product category diversification is a major feature of China's wire and cable industry, covering five major categories: power cables, electrical equipment cables, bare wires, winding wires and communication cables. Among them, power cables are known for their wide range of application scenarios. It occupies the largest market share, about 39%, followed by electrical equipment cables, accounting for 22%. In addition, as China Southern Power Grid Corporation announced that it will invest approximately 670 billion yuan in the construction of digital grids and modern power grids during the "14th Five-Year Plan" period, this move will undoubtedly promote the construction and development of new power systems and bring benefits to the wire and cable industry. Come to new growth points. Looking to the future, by 2027, the market size of China's wire and cable industry is expected to reach nearly 1.6 trillion yuan, fully demonstrating the industry's huge development potential and broad market prospects.

According to statistics from Zhiyanzhan, the market size of China's wire and cable industry was 1.06 trillion yuan in 2019, and the market size of China's wire and cable industry in Q1 2024 was 0.31 trillion yuan, a year-on-year increase of 2.92%. The market size of China's wire and cable industry from 2019 to 2024Q1 is as follows:

Chart: China’s wire and cable industry market size from 2019 to 2024Q1

Forecast of development prospects of wire and cable industry

The wire and cable industry has broad development prospects, which are affected by multiple factors such as market demand, technological progress, policy environment, and international competition. With the acceleration of globalization and industrialization, the demand for wires and cables in infrastructure fields such as power, communications, transportation, and construction will continue to grow, and the rise of emerging industries such as new energy, electric vehicles, and smart manufacturing will also bring changes to the industry. new growth points. At the same time, the continuous emergence of new materials, new processes, and new technologies will promote the performance upgrade of wire and cable products, and the application of technologies such as intelligence and automation will also improve the production efficiency and quality level of the industry. In terms of policy environment, the country's increasingly stringent requirements for energy, environmental protection, safety and other aspects will prompt the wire and cable industry to strengthen supervision and standard formulation. At the same time, policy support will also provide strong support for the industry's technological innovation and market expansion. However, international competition will also become increasingly fierce, and companies need to continuously improve their technological innovation capabilities and product quality to cope with challenges from all over the world.

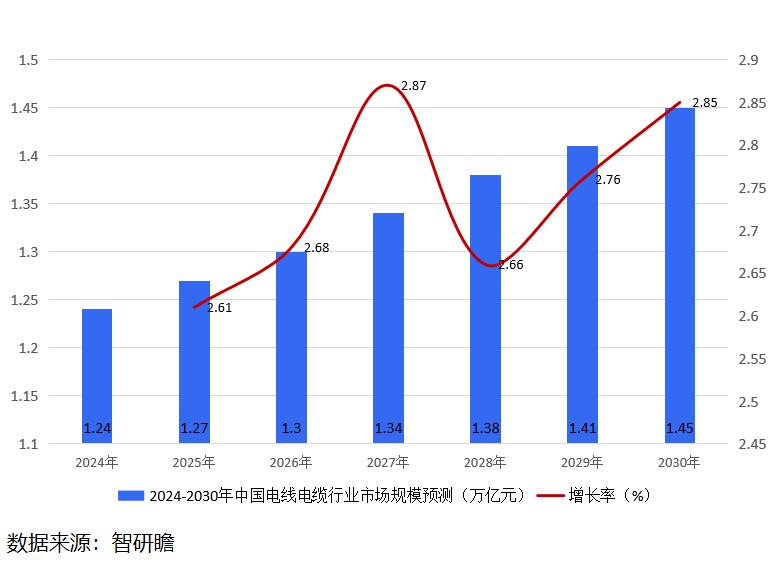

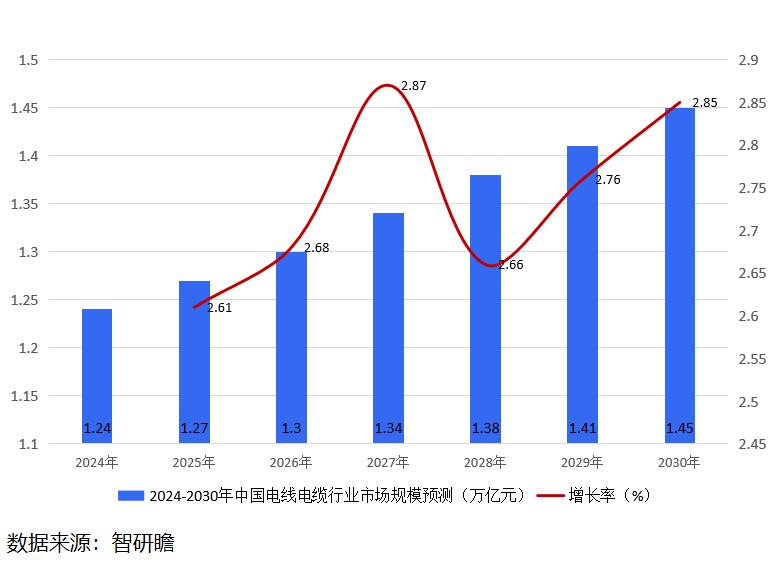

According to Zhiyanzhan's prediction, the market size of China's wire and cable industry will grow at 2.6%-2.92% from 2024 to 2030. In 2030, the market size of China's wire and cable industry will be 1.45 trillion yuan, a year-on-year increase of 2.85%. The market size forecast of China's wire and cable industry from 2024 to 2030 is as follows:

Chart: Forecast of market size of China’s wire and cable industry from 2024 to 2030

Jiangsu Liqiang Mechanical & Electrical Co., Ltd. is a professional wire and cable production manufacturer, providing a full spectrum of services from development design and whole plant planning to technical advice, manufacture, installation, commissioning, and after-sales service.

Our main products include wire drawing machines, annealing machines, wire bunching machines, and other related equipment tailored for bare copper, copper alloy, stainless steel wire, and more. We leverage advanced production equipment and technology to ensure internationally advanced levels of quality, structure, performance, and appearance in every product we deliver.

While based in China, our products have earned the trust and support of customers across China and Southeast Asia, the Middle East, South Africa, and beyond. Our international presence reflects the recognition of our commitment to quality and customer satisfaction.

Get in Touch:

We invite you to explore our range of products and services and discover how Jiangsu Liqiang Mechanical & Electrical Co., Ltd. can meet your Drawing Process Machine needs. Contact us today to learn more about how we can assist you in achieving your goals.

Web:https://www.wire-cable-machine.com/

Tel:+86-515-85278669

Fax:+86-515-85318669

E-mail: [email protected]

中文简体

中文简体 русский

русский Español

Español عربى

عربى

Contact Us